When there are Stockouts, people often blame poor forecasts or sudden change of demand or blame of suppliers, but the real problem runs deeper. In most supply chains, inventory decisions are made locally, not across the network.

One warehouse is overstocked while another runs dry, and no one sees the full picture. In fact, research shows that 70% to 90% of stockouts result from poor inventory replenishment. This is where MEIO (Multi-Echelon Inventory Optimization) helps.

It fixes stockout by optimizing inventory across the whole network so products are available where customers actually need them while in the meantime not spiking up the cost of transportation because companies should not be transferring too much stock across networks either . So, if you’re ready to learn more about how it helps, let’s get into it.

The Structural Drivers of Network-Wide Stockouts

Here are the hidden reasons behind stockouts that affect your entire supply chain network.

1. Inaccurate Customer Demand Predictions

Stockouts often start with wrong forecasts. When predictions miss the mark, companies either run out of stock or overcompensate with excess inventory. This mismatch creates inefficiencies across the network.

Inaccurate demand data can also cause planners to make frequent emergency orders. Such errors are common examples of supply chain planning mistakes that can ripple across the network.

2. Siloed Planning and Decentralized Decision-Making

When planning is done in silos which is often the case, each location decides its stocking and replenishment needs independently. This leads to safety stock in the wrong places, where buffers exist but are not where they are most needed.

Without network-level visibility and optimization, local decisions may conflict. The conflict causes some warehouses to have excess inventory while others face chronic shortages.

3. Safety Stock in the Wrong Places

Placing stock incorrectly wastes capital and does not prevent shortages. The inventory may sit idle in low-demand areas while high-demand locations run out.

This misallocation forces companies to carry higher total inventory than necessary, increasing holding costs and reducing profitability.

Related Read: https://sophus.ai/the-shortcoming-of-the-legacy-inventory-planning/

4. Uncertainty That Grows Across the Network

Volatile demand and fluctuating lead times increase uncertainty. Local decisions that seem correct can create global problems elsewhere in the supply chain.

As uncertainty compounds through multiple echelons, planners struggle to predict shortages, often resulting in either overstock or missed demand.

5. Supply chain disruptions

Supply chain disruptions, such as natural disasters, labor strikes, material shortages, or production issues, can trigger stockouts. Poorly managed inventory and a lack of coordinated planning amplify network vulnerabilities.

During major events like the pandemic, purchase order changes rose from 40% to over 60%, increasing demand variability and stockout risk.

6. Local Targets Creating Global Problems

When individual sites pursue local service targets without considering the network, it creates global inefficiencies. Each warehouse or store may look optimized alone, but the network suffers collectively.

For example, one warehouse may maintain high stock levels to meet its local target, while another suffers a stockout, creating lost sales at the network level.

7. Poor Visibility of End-to-End Risk

Limited insight into the network prevents proactive action. Planners cannot easily identify where inventory is most needed or which nodes are most at risk.

Without visibility, companies respond reactively to stockouts rather than preventing them, which drives up costs and reduces service levels.

Why Traditional Inventory Planning Falls Short

If you are relying on forecasts to keep inventory available, you are already taking on more risk than it seems. Forecasts assume demand will behave as it did in the past, but you see every day that it does not.

Promotions, delays, and shifting customer behavior quickly turn small forecast errors into empty shelves in one location and excess stock in another. When planning is built around forecasts alone, you are constantly chasing problems rather than staying ahead of them.

Without a network-level view, your team ends up firefighting. Inventory gets moved around, and orders are expedited just to keep service levels from dropping. That constant reaction is not a planning failure; it is a visibility problem.

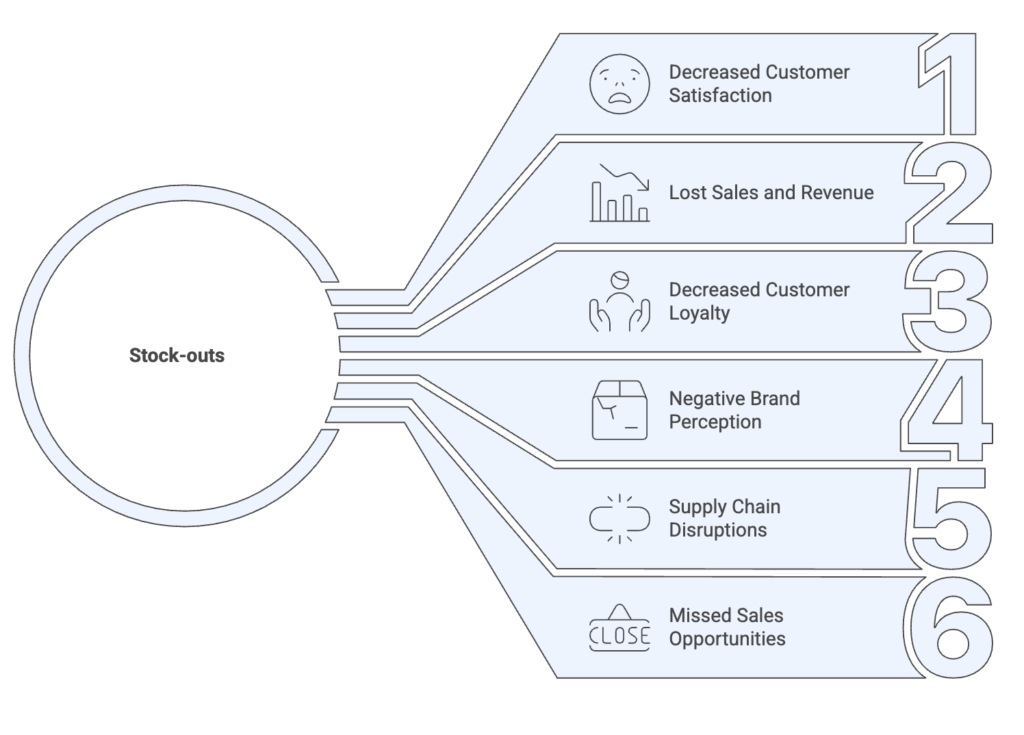

How Stock-outs Impact Your Business

Stock-outs disrupt customer trust, delay fulfillment, and force costly expediting. Over time, they erode revenue, damage service levels, and weaken long-term competitiveness.

- Decreased customer satisfaction: Stockouts frustrate customers and prevent them from getting what they need.

- Lost sales and revenue: Missed sales opportunities directly impact revenue and profitability.

- Decreased customer loyalty: Frequent shortages erode trust and may drive customers to competitors.

- Negative brand perception: Repeated stockouts can damage reputation and make the business appear unreliable.

- Supply chain disruptions: Frequent stockouts can indicate production optimization failure, transportation, or inventory management issues.

- Missed sales opportunities: Out-of-stock products reduce chances for cross-selling or upselling, limiting revenue growth.

How You Can Manage Inventory with MEIO

MEIO can transform your supply chain and prevent network-wide stockouts if done well:

1. Managing Inventory as One System

MEIO views the supply chain as an integrated network, not separate nodes. This approach optimizes inventory across all locations, reducing waste and shortages.

2. Putting Safety Stock Where It Matters Most

MEIO identifies the best locations for safety stock, eliminating misplaced inventory and improving service levels.

3. Sharing Risk Across the Network

Instead of each node holding separate buffers, MEIO pools risk across the network. This reduces overall inventory while maintaining availability.

4. Aligning Service Targets Across Locations

MEIO ensures all sites follow a service goal that can both meet its local needs but also considering the overall impact, avoiding local decisions that could harm the network.

5. Planning for Disruptions Before They Happen

Predictive analytics and inventory planning within MEIO help companies anticipate disruptions and adjust inventory proactively, reducing firefighting.

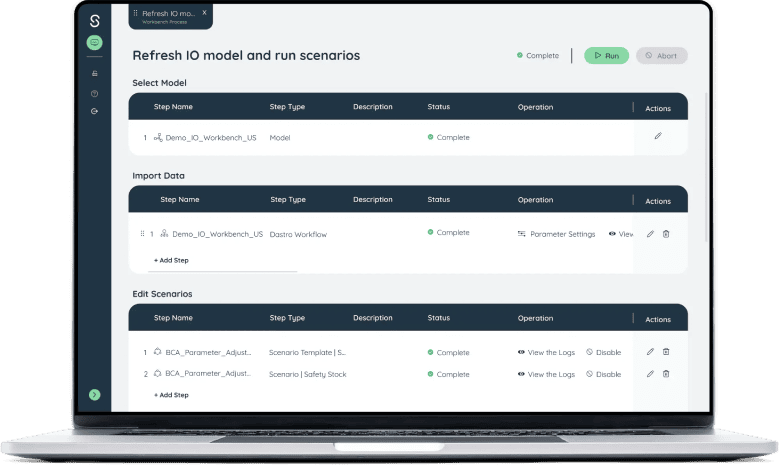

MEIO in Action: How Sophus Optimizes Inventory Across Complex Networks

Explore real-world examples of companies successfully using Sophus to balance inventory and improve service.

Pharma Giant Optimizes Inventory with AI

A global pharmaceutical company partnered with Sophus to replace fragmented, Excel-based planning with an AI-driven MEIO approach. By connecting inventory decisions across raw materials, intermediates, and finished goods, the company gained end-to-end visibility into inventory drivers, reduced excess stock, and protected service levels unlocking tens of millions in working-capital savings while shifting to continuous, data-driven planning.

Food Distributor Turns Inventory Chaos into $10M Win

A food distributor struggling with excess inventory and inconsistent service used Sophus to optimize inventory across its network. By modeling interdependencies between locations and rebalancing stock positions, the company uncovered hidden inefficiencies and achieved $10M in net value, improving fulfillment performance while reducing inventory.

Strengthen Your Supply with Chain Sophus

Network-wide stockouts are often caused by disconnected planning and misplaced inventory, not just low stock or inaccurate forecasts. Traditional approaches fail to prevent shortages and can increase costs.

MEIO solves this by optimizing inventory placement, sharing risk across the network, and aligning service targets. When integrated with annual operating plans and network redesign, MEIO enhances resilience and efficiency.

To end stockouts and strengthen your supply chain, explore a tailored MEIO solution with Sophus AI today.

Frequently Asked Questions

1. Is MEIO suitable for all industries?

MEIO works best for companies with multi-location supply chains, including pharmaceuticals, food distribution, retail, and manufacturing, where stockouts or excess inventory have a significant business impact.

2. How long does it take to see improvements after implementing MEIO?

While results vary, companies often notice better inventory balance, fewer emergency orders, and improved service levels within a few months. Some case studies show measurable cost savings and increased availability even faster.

3. Does MEIO replace forecasting?

No, MEIO complements forecasting. Forecasts provide expected demand, while MEIO ensures that inventory is optimally placed across the network to meet that demand efficiently.