1. Overview

In 2025, America’s trade policy has taken a sharp turn. A new round of tariffs, introduced by the current administration, is now sending shockwaves through global supply chains—but not in the way many expected. Instead of boosting U.S. manufacturing or reducing the trade deficit, what we’re seeing so far is hesitation and slowdown. Companies around the world are putting plans on hold, cutting jobs, freezing investments, and in some cases, shutting down operations entirely.

According to The New York Times, many large U.S. importers are now in “triage mode,” trying to manage higher costs while dealing with lower demand. The effects are also being felt in the logistics world. UPS, often seen as a good indicator of global trade activity, has laid off workers due to a drop in shipping volumes. As The Guardian reported, slower trade is starting to make it hard for companies to justify keeping all of their existing infrastructure running. (The Guardian)

What’s even more concerning is the longer-term impact. Tariffs are more than just extra costs—they send a message. And when that message is repeated over and over, businesses start to rethink the global supply networks they’ve spent decades building. Right now, many companies are reacting out of fear instead of adapting with a plan. They’re stepping back, cutting spending, and delaying key decisions.

So the real question is: are we making things worse by relying on short-term solutions? Because at the moment, the usual playbook isn’t just falling short—it might be creating new risks.

There is likely a better way forward—one that doesn’t depend on waiting for the next sudden policy change. But first, we need to take a closer look at how these tariffs are actually changing—and in many cases, damaging—how supply chains work.

2. Tariffs Disrupting Global Supply Chains

Tariffs used to be tools for negotiation—something governments used to protect local industries or settle trade disputes. But today, they’ve become powerful disruptors of global supply chains. Major examples like the Section 232 tariffs on steel and aluminum, and the Section 301 tariffs on Chinese goods, have shaken up how companies around the world source and manage materials.

These policies were originally meant to give domestic industries a boost. But over time, they’ve ended up creating long-term uncertainty, forcing businesses to rethink how and where they produce and source goods.

Mounting Costs to Importers

According to the U.S. International Trade Commission, by 2021 these tariffs had cost U.S. importers tens of billions of dollars annually. That kind of cost increase has made many companies think twice before placing cross-border orders and now close to 2025 and forward this trend will continue.

???? USITC Report

Two Major Supply Chain Impacts

The consequences of sustained tariff regimes can be broken down into two primary categories:

1. Disrupted Investment in Upstream Supply

Suppliers, especially in industries like electronics and heavy machinery that require big upfront investments, are holding back. They’re less willing to commit to new factories or equipment when trade rules can shift so quickly. Many expansion plans have been paused—or canceled entirely.

2. Volatile Input Costs and Resource Availability

- Tariffs have also driven up the prices of key materials like lumber, lithium, and aluminum. For example, in the housing industry, the cost of things like engineered wood and insulation has jumped, adding thousands of dollars to the price of building a new home.

???? NAHB Source

Broader Supply Chain Volatility

This isn’t just about prices going up. Companies are also dealing with more uncertainty when it comes to getting the materials they need. It’s a bit like trying to run a business in a country where the currency changes value every week—planning gets a lot harder.

We’re seeing three big shifts:

- Suppliers are adding “risk premiums” to their prices.

- Trust in supplier reliability is fading.

- Businesses are holding more inventory as a safety net.

In short, the old “just-in-time” model is being replaced by new, more cautious strategies—ones that accept uncertainty as the new normal.

Tariffs don’t just change prices—

3. Tariff Disruption Hurts Business

they quietly squeeze the life out of business operations in ways that are easy to underestimate. Let’s break down three major ways companies are feeling the pain.

Margin Erosion:

Tariffs may start as trade policy, but their impact shows up fast on company balance sheets. With input costs going up and fewer sourcing options available, expenses rise across the board. For businesses already operating on thin profit margins, there’s little room to adjust.

Across industries like consumer goods and manufacturing, reports show that average profit margins have dropped by 2–3 percentage points since tariffs took effect. That might not sound huge, but in competitive markets, it’s enough to turn a healthy business into one that’s barely breaking even.

Inventory Problems: Too Much and Not Enough

Another side effect? Inventory chaos. To avoid delays or future price hikes, companies start stockpiling materials. But that safety strategy can backfire.

Warehouses fill up with excess stock, tying up valuable cash. Meanwhile, if demand shifts or forecasts are off, some products go obsolete while others run out. The result: companies face both stockouts and overstocks—hurting sales, clogging up operations, and putting even more pressure on margins.

Halting CapEx

Businesses ready to grow or modernize are suddenly hitting the brakes. A 2023 Cambridge study showed that companies affected by upstream tariffs, like those under Section 301, sharply reduced their capital spending.(Cambridge Study). Instead of investing in new factories or better technology, they started saving for emergencies—just in case things got worse.

To put it simply: when trade policy becomes unpredictable, businesses stop building for the future. But here’s the cost of that caution—by not investing in adaptability or scale, companies lose the very strengths they need to survive and grow when conditions improve.

4. The Default Reaction: Cut Costs First, Wait for Clarity Later

When faced with geopolitical uncertainty, most companies fall back on a familiar playbook: cut quickly, ride out the storm, and hope things return to normal. As tariffs push costs higher and profits lower, many leaders reach for the quickest lever they can pull—cutting labor and delaying investments.

The results? Sharp and visible. UPS let go of over 12,000 employees, blaming a mix of economic pressure and policy uncertainty. That phrase—“policy uncertainty”—is often just code for tariff trouble slowing down global trade.(The Guardian)

Furniture maker La-Z-Boy closed factories and paused upgrades to its distribution centers due to rising material costs. Even retail giants like Walmart and Home Depot slowed down their growth plans, holding back and watching tariff announcements like traders watch the stock ticker.

On the investment front, sectors that rely on global raw materials—like steel, lithium, and semiconductors—have gone quiet. The thinking is straightforward: if your key inputs now cost 25% more, why spend millions on new facilities that may never deliver strong returns?

The New York Times highlighted how some companies have stopped major investments altogether, unsure whether this environment is temporary or the new normal. (The New York Times)

Some businesses have tried to sidestep the problem by shifting where they source materials—looking to countries not (yet) hit by tariffs. But that’s easier said than done. Supply chains are like spider webs—complex, delicate, and not something you can re-spin overnight. Rerouting often brings extra shipping costs, new risks, and legal or compliance issues just as painful as the tariffs they were trying to avoid.

All in all, these moves feel more like firefighting than long-term strategy. And that’s the deeper issue: companies are reacting, not planning—when what they really need is a better roadmap for what’s next.

5. A Smarter Way Forward: Proactive Supply Chain Optimization

Cutting costs and pausing investments may help businesses stay afloat in the short term—but over time, this approach can hold back recovery and growth. As tariffs continue to push up the cost of materials, labor, and transport, companies can’t afford to simply wait things out. The real path forward is adaptation.

That’s where proactive supply chain optimization comes in. Instead of just reacting to disruption, companies can turn uncertainty into an opportunity to plan smarter and operate leaner.

1. Plan Ahead with Scenario Modeling

Rather than waiting for tariffs to hit, some companies now model out different “what-if” scenarios in advance. What happens if steel prices spike again? What if new tariffs are placed on imports from a key supplier country?

By simulating these kinds of risks before they happen, companies can plan ahead—rerouting production, shifting suppliers, and adjusting sourcing strategies. This kind of modeling helps protect margins and avoid last-minute scrambles when new policies or price shocks roll in.

2. Remove Waste from the System

Many supply chains are full of hidden inefficiencies: excess inventory, mismatched transport modes, outdated sourcing patterns, or poorly timed production. Optimizing these areas—tightening lead times, improving asset use, and better aligning supply with demand—creates flexibility that pays off during times of volatility.

The companies that are doing well in today’s unpredictable environment aren’t just surviving—they’re fine-tuning their operations to become more resilient and responsive.

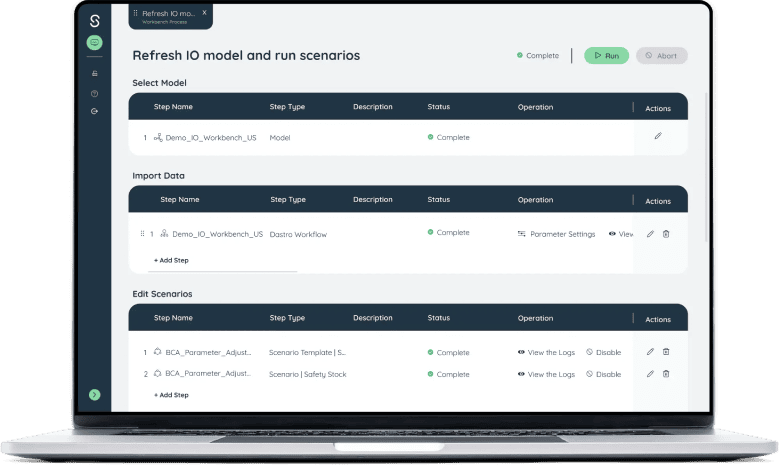

3. Use the Right Tools to Drive Better Decisions

Responding to tariff pressure isn’t just about having good instincts—it requires data, modeling, and decision support tools.

Advanced platforms like Sophus Supply Chain Network Design, help businesses simulate and evaluate different supply chain setups before making big decisions. These tools allow companies to compare cost, lead time, and service tradeoffs across multiple configurations—like changing distribution hubs or switching suppliers. In a world where capital spending is limited, being able to test scenarios digitally first is a huge strategic advantage.

4. Rethink Inventory Strategies

Inventory is another area where optimization matters. Leading firms are now using segmented strategies—adjusting stock levels based on product behavior, demand patterns, or customer needs. Others are adopting dynamic replenishment models that respond quickly to demand signals.

The result? Less excess, fewer shortages, and more working capital freed up to invest elsewhere.

5. Know Your True Margin to Serve

Finally, margin-to-serve analysis is helping businesses understand their full cost picture—not just what they spend on goods, but what it really costs to move, store, and deliver them under different scenarios.

By including tariff impacts alongside freight, warehousing, and service-level costs, companies can get a much clearer picture of where value is created—or lost—across the entire network.

In short, the companies that win in this new era won’t be the ones that simply cut back and hope. They’ll be the ones that optimize with intent, plan with clarity, and build supply chains that are ready for anything.

6. Optimization in Supply Chain Planning

Even as tariffs, trade shocks, and geopolitical instability shake the foundation of the global supply chain, many companies are still planning as if the world is predictable. Long-term supply chain plans—spanning 12, 18, even 36 months—were built for a stable environment.

Today, lead times can change rapidly. Material costs jump without warning. And regional disruptions spread faster than most legacy systems can keep up. In this reality, static plans don’t just fall short—they put companies at risk.

From Static to Dynamic: The Need for Dynamic Supply Chain Optimization and Orchestration

To stay competitive, supply chain planning must evolve from fixed schedules to adaptive, optimized strategies.

That means letting go of guesswork and using tools that can simulate and optimize not from a heuristic perspective which many planning solutions do support but from a holistic perspective.

Leading companies are adopting optimization technology that:

- Evaluate different sourcing and production decisions

- Stress-test their plans against tariffs, supplier delays, and demand swings

- Pinpoint hidden weaknesses—like overdependence on expensive ports or too much buffer stock in underperforming regions

- Closely align supply chain planning with the financial budget

By simulating and optimizing outcomes under stress, companies can make better-informed, cost-effective decisions.

Smarter Inventory Planning

Holding more inventory might feel like a safe bet, but in the long run, it ties up cash and adds risk. The better approach is intelligent inventory optimization. Here’s what that looks like:

- Setting safety stock levels that balance cost control and customer service

- Using smart algorithms to segment inventory by value, risk, and how often it needs restocking

- Avoiding blanket rules and tailoring stock strategies based on actual product behavior

This way, companies avoid both shortages and overstock—and free up capital in the process.

???? See how this approach plays out in practice: Holistic Inventory Optimization by Sophus AI

Optimization Is No Longer Optional

Companies that can constantly realign their plans, and use data and technology to guide decisions, will be the ones that stay ahead in unpredictable markets.

Those still relying on static forecasts and spreadsheets? They’re betting on a version of the world that no longer exists.

The future belongs to companies that are fast, flexible, and algorithm-driven.

Final Chapter: From Surviving to Leading

Over the past chapters, we’ve seen a common thread: tariffs, uncertainty, and global shocks aren’t short-term problems—they’re the new reality. But while many companies remain stuck in reaction mode, others are quietly reshaping their future by investing in what matters most: resilience through optimization.

Here’s what we’ve learned:

- Laying off and shutting down may buy time, but it rarely builds strength.

- Waiting for clarity is not a plan—it’s a gamble.

- Supply chain optimization isn’t just a tech initiative—it’s a leadership mindset.

- Resilience doesn’t mean avoiding disruption. It means adapting faster and smarter than your competitors.

The companies that will lead tomorrow aren’t waiting for stability. They’re building it—node by node, decision by decision, powered by data and strategy.

A Call to Action for Leaders

If you’re an executive navigating this uncertain environment, the most important question you can ask isn’t should I lay off 10,000 employees? It’s what’s the smartest move?

- Are your supply chain plans flexible enough to shift?

- Do you know the full cost-to-serve across every region, product, and channel?

- Can your team simulate disruption before it happens—and respond with precision, not panic?

If not, the time to start is now.

FAQs

1. How do tariffs impact the global supply chain and global companies?

Tariffs act like a tax on cross-border trade, making imported goods and materials more expensive. This added cost spreads through the entire supply chain—pushing up expenses, tying up working capital, and forcing companies to either shrink their profit margins or raise prices for customers. For global companies that rely on and benefit from the global supply chain, the impact is immediate. Contracts get disrupted, shipping costs rise, and planning becomes a guessing game. A clear example: U.S. tariffs on Chinese goods led logistics firms like UPS to cut jobs and close facilities to control costs(The Guardian) Bottom line: tariffs often lead to inefficient supply chain changes—not because they make sense economically, but because companies are trying to avoid risk and uncertainty.

2. What technologies help companies optimize their supply chains amid trade risks?

Modern supply chains are moving toward digitally enabled resiliency. Technologies like Supply Chain Optimization platforms allow companies to simulate and redesign their networks under shifting tariff regimes (Supply Chain Network Design). AI-driven digital twins offer scenario planning, testing multiple ‘what-if’ configuration. Predictive analytics identifies hidden cost exposures well before they appear in the P&L. Together, these capabilities shift the supply chain mindset from reactive adaptation to strategic foresight.

3. How can companies future-proof their supply chains against tariff shocks?

The best defense is adoptability. Companies that build adaptability into their supply chains—from how they source materials to how they move inventory—are better equipped to handle shocks. Tools like dynamic network planning Supply Network Optimization,, inventory optimization, and cost-to-serve analysis allow businesses to adjust without sacrificing service or profitability. The goal isn’t just to survive disruptions—it’s to use your supply chain as a strategic advantage, even when the trade winds shift.