Tax and Duties Optimization

Challenges

Complex and rising tax/duty costs: Taxes and duties are now a major cost driver in global supply chains, particularly in countries like Brazil and India with intricate tax structures. Simultaneously, escalating tariffs due to trade wars and geopolitical shifts add volatility to global operations.

Siloed decision-making: Taxes and duties are often managed in isolation by finance teams, creating misalignment with supply chain decisions. This leads to suboptimal trade-offs between operational costs (e.g., logistics, inventory) and tax/duty burdens.

Sophus Solution

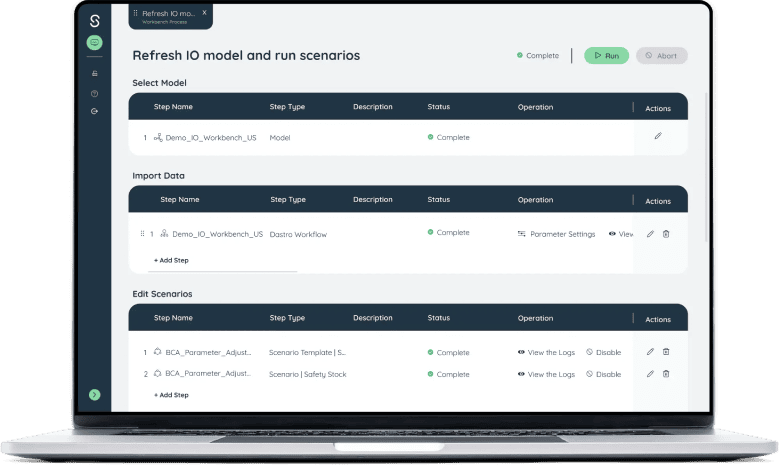

Integrated tax/duty modeling: Sophus incorporates taxes and duties as decision variables alongside traditional supply chain costs (e.g., production, transportation). The platform accommodates complex tax regimes, enabling holistic optimization of end-to-end costs.

Dynamic scenario planning: Rapidly simulate “what-if” scenarios to assess impacts of tax/duty changes (e.g., tariff hikes, regulatory shifts) and identify resilient supply chain strategies to hedge risks.

Benefits

10–20%

reduction in tax/duty burdens: Optimize network design, sourcing, and routing to minimize exposure to high-tax jurisdictions or inefficient duty structures

Improved margins:

Balance tax/duty costs with operational expenses to unlock hidden savings and enhance profitability.

Proactive risk management: Anticipate and adapt to tax/duty volatility, ensuring compliance while maintaining supply chain agility.

Request a demo