Introduction

When companies feel the squeeze, the default instinct is often layoffs and asset closures. It’s fast, it’s measurable, and it makes the boardroom feel productive. But it’s also a blunt instrument with long-term costs that rarely get factored in until it’s too late. Over 60% of companies opt for headcount reductions when downturns hit. In contrast, less than 30% look inward—to their own supply chains—for smarter, structural cost improvements.

That’s a massive blind spot. Because while cutting talent erodes capability, optimizing your supply chain strengthens it. Done right, it can lower costs, improve service, and build resilience—all without sacrificing the people and processes that drive growth.

The difference comes down to short-term survival vs. long-term strength. As noted in the Harvard Business Review, companies that combine structural cost transformation with smart operational shifts don’t just survive downturns—they come out stronger.

???? Related link: Cost Cutting That Makes You Stronger

So, what if the sharpest way to cut… doesn’t involve cutting heads at all?

Short-Term Cuts: Layoffs and Closures

On paper, layoffs and site closures look clean—fast actions that trim costs and please shareholders. But once you scratch the surface, these moves carry hidden (and compounding) damage. Morale takes a dive. Tribal knowledge walks out the door. And when growth returns, expensive rehiring and retraining bills show up right on time.

Then there’s disruption. Global supply chains depend on continuity. Shutter a distribution center or cut core operational staff, and you’re not just saving money—you’re poking holes in your own network. Those holes take time and capital to patch, often under higher rates or longer lead times.

What makes this messier? Add tariffs, inflation, and the fight for skilled labor. Cutting a site in this climate—a decision companies like FedEx have publicly wrestled with—doesn’t just mean shutting down a cost center. It means losing strategic ground in an already volatile trade and workforce environment (FedEx Company Overview).

So the question isn’t whether these cuts save anything. They do. It’s whether the savings are worth the long-term setbacks. And for many, that answer is changing fast.

Supply Chain Optimization as a Smarter Cost-Cutting Strategy

Cutting heads is fast. Cutting waste is smarter.

Supply chain optimization targets operational slack without gutting your business. Instead of trimming talent, it reworks how your network, production, inventory, and logistics behave together. When done right, it quietly lowers the cost-to-serve by attacking structural inefficiencies—unused capacity, misaligned routes, bloated safety stock. The result? Service levels climb while costs fall.

This isn’t a theory. It’s modeled and measurable.

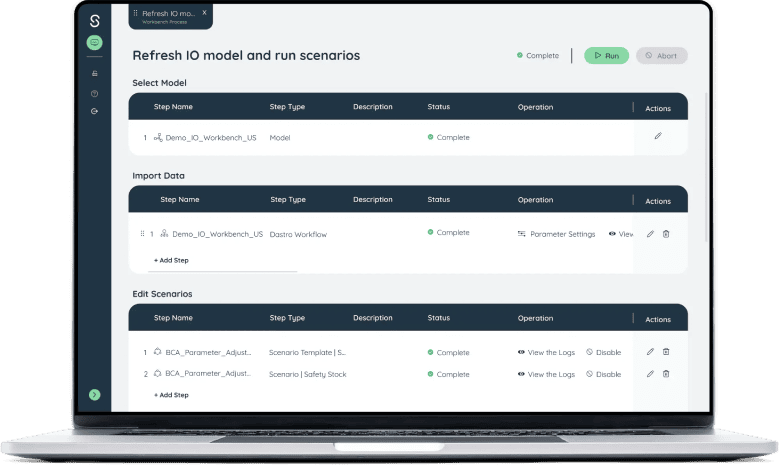

With optimization technology, you can simulate cost-saving scenarios before acting. You see the impact of shifting DC locations, rerouting shipments, or changing supplier terms—all without layoffs or site closures.

Put simply, smarter design beats blunt cuts. That’s why forward-looking firms are investing in network strategy and scenario planning tools. As noted in this sharp take on the subject, supply chain optimization consistently outperforms other big-ticket investments in tight market conditions

???? Also read: Why Supply Chain Network Design and Optimization Over Other Investments

Optimization isn’t just saving money—it’s protecting momentum.

Key Levers of Optimization in Supply Chains

Cutting costs doesn’t have to mean cutting people. The trick is to find the dollars hiding inside your supply chain. Five levers can unlock them—without gutting teams or shutting down infrastructure.

Start with network design. Rethink where your plants and distribution centers are located. You don’t need more facilities—you need the right ones, in the right places, serving the right customers. A small shift in allocation or routing can shave millions.

Then there’s inventory. It’s not about stocking more or less; it’s about aligning supply with demand at a granular level. Through holistic inventory optimization, you can put the right product in the right place at the right time—and avoid tying up cash in the wrong SKUs. Want proof? It works. Just look at how end-to-end optimization, as detailed here, drives better outcomes with less waste.

Sales and operations planning (S&OP) isn’t just a coordination meeting—it’s a strategic play. Dialing in optimized production and logistics models helps rebalance supply against demand when markets shift fast.

Replenishment optimization is another underused lever. The goal is to walk the tightrope between service levels, working capital and transportation cost. You don’t win by erring on either side; you win by using data to strike balance.

???? Related link: Replenishment Optimization

And finally, budgeting. If you’re using last year’s run rate plus 5%, you’re already behind. Replace reactive cost-cutting with anticipatory modeling. Annual budget planning through scenario design lets you get out in front of volatility—so you’re planning, not panicking.

None of this is magic. It’s just smarter supply chain strategy.

Operational Impact vs Financial Metrics

Supply chain optimization doesn’t just trim fat—it reshapes the entire cost structure. Network redesigns alone can cut logistics and fulfillment costs by 10–25%, often with no impact on jobs. That kind of savings doesn’t come from trimming headcount—it comes from removing friction across nodes and routes.

Layoffs may get you short-term margin relief, but they hollow out what makes a company work. Talent walks. Continuity erodes. Restarting after a downturn becomes a much heavier lift. The cost to rebuild often outweighs what you saved.

In contrast, supply chain optimization delivers savings that compound. Whether you’re facing inflationary pressure, rising labor costs, or volatility from tariffs, structural efficiencies hang tough. They’re not band-aids—they’re safety nets. As illustrated in this recent MIT research on dynamic supply chains, optimization creates a financial buffer without undermining future capability—a critical difference when market conditions shift fast (Essays on Dynamic Supply Chains).

The bottom line? Lower cost-to-serve. Stronger margins. No talent loss. Optimization isn’t just a smart move—it’s the sustainable one.

Case Insight: Strategic Optimization at Work

McKesson didn’t pull the emergency brake when healthcare costs surged. Instead of slashing headcount or shuttering sites, they took a scalpel to their supply chain. By tightening up inventory policies and re-engineering delivery routes, McKesson offset inflationary pressure without compromising service or shedding talent. That’s what operational discipline looks like in a volatile market. Their operational playbook shows what’s possible when optimization leads, not layoffs.

We’re seeing the same pattern among tech-forward retailers and pharma giants. When budgets tighten, the best don’t cut people—they cut inefficiency. These companies weaponize data to isolate what’s broken in the supply chain and rebuild it smarter. It’s a move that protects continuity and compounds savings over time. The signal is clear: those investing in optimization today are skating ahead of tomorrow’s disruptions.

Conclusion

If you’re serious about cutting costs without gutting your business, look to the supply chain first. Optimization isn’t just cleaner—it’s smarter. It shields your people, your operational DNA, and your relationships with customers. Layoffs and closures can feel decisive in the short term, but they leave marks that cost more to repair down the road.

Real transformation comes from having the right products, at the right place and time, flowing through a network built for efficiency. Supply chain optimization delivers lasting cost reduction without gutting capability. It’s not an either/or: a well-optimized network makes tough decisions less frequent—and less damaging.

The businesses playing the long game are already doing this. They invest in models, data, and tools now, so they don’t have to panic later. For a deeper look at how supply chain optimization underpins sustainable cost control, check out this breakdown on supply network design and optimisation: What Is Supply Chain Network Design and Optimisation.

Cut smarter. Stabilize faster. Optimize first.

FAQs

1. How does supply chain optimization reduce the need for layoffs or closures?

When you’re bleeding cash, cutting headcount might feel like the fastest fix. It’s not. Supply chain optimization tackles the root cause—structural inefficiencies in how your business moves, stores, and delivers products.

Here’s how it helps:

· Redesigns networks to eliminate waste

· Improves end-to-end material flow

· Reduces cost per unit without impacting headcount or capacity

· Preserves team morale and operational capability

2. What’s the ROI of network optimization compared to labor cost savings?

Network optimization typically delivers 10–25% in sustainable cost savings, with none of the cultural fallout caused by layoffs.

Compared to workforce cuts:

· Labor cuts may offer a short-lived bump in savings

· Hidden costs often include:

· High turnover

· Productivity dips

· Retraining expenses

Why network optimization wins in the long run:

· Benefits are cumulative and compounding

· Enhances resilience and scalability

· Acts as a form of strategic future-proofing

???? Read more in this: breakdown of why firms should prioritize network optimization.

3. Can data-driven supply chain tools help navigate tariffs and macro disruptions?

Absolutely. Today’s AI-powered supply chain tools go far beyond basic mapping. They simulate scenarios so companies can plan ahead instead of reacting.

What modern tools account for:

· Tariff exposure

· Inflation trends

· Lead time volatility

Supplier risk variability Key outcomes:

· Smarter inventory placements

· Diversified and resilient routing

· Fewer surprises amid global disruptions