1. Intro: No Time Like Pre-Turbulence

Most companies don’t rethink their supply chains until something starts to break. That’s the problem. By the time a disruption hits—whether it’s a tariff whiplash or earnings falling off a cliff—it’s too late to “optimize” anything meaningfully. Emergency fixes are rushed, expensive, and rarely stick.

Being proactive in supply chain management isn’t about chasing perfection. It’s about building a system that flexes without snapping when stress hits. The difference between proactive and reactive operations isn’t theoretical. It shows up in lead times, margins, and the number of boardroom fire drills.

And make no mistake: pressure is mounting. Whether it’s the threat of economic slowdowns, stricter tariffs, or geopolitical curveballs, volatility is becoming a baseline condition. You can’t wait until you’re midair to buy a parachute. The right time to optimize isn’t after turbulence—it’s before you feel the bump. Recession impact on supply chains is already showing just how exposed reactive strategies really are.

???? Related link: How Does a Recession Impact Your Supply Chain?

Slack supply chains are a luxury no one can afford anymore.

2. Common Triggers for Crisis-Mode Optimization

A. Economic Downturns & Layoffs

When the economy contracts, companies cut fast—headcount, capital spend, and often, common sense. Supply chains designed for smooth, steady growth begin to buckle under pressure. Recessions have a way of exposing the inefficiencies hidden in plain sight: siloed data, clunky manual processes, and inventory that’s more ballast than buffer. What once passed as ‘good enough’ is suddenly glaringly wasteful when margins evaporate.

As this analysis shows, downturns ripple through supply chains in waves—from dropping demand to shaky vendors—throwing entire operations into reaction mode. That’s when procurement panics, freight costs soar, and lead times stretch thin. Ironically, just when stability is most needed, control becomes the hardest thing to hold onto.

B. Tariff Shocks

Tariffs don’t knock—they slam the door. Whether it’s an overnight change in trade policy or a retaliatory duty hike, the global supply chain faces sudden stress tests. Cost models built on free-flowing imports collapse. Lead times extend. Margins get clipped.

Without pre-optimized sourcing options or flexible capacity models, companies often overcorrect—cutting too deep or pivoting too late, hemorrhaging value along the way. It’s a chain reaction that punishes unprepared networks.

C. Downsizing Supply Networks

Retrenchment sounds tidy on a slide deck: “rationalize the supplier base” or “consolidate nodes.” But operationally, it’s a minefield. Fewer partners mean higher exposure. One delayed shipment or quality misfire and you’ve got no fallback.

Inventory becomes harder to balance. Fill rates drop while carrying costs rise. And with fewer levers to pull, planners lose options at precisely the moment they need agility. Shrinking the network to cut costs can unintentionally build fragility into the system itself.

All of these triggers have one thing in common: they force optimization when it’s already late. That’s why waiting to fix your supply chain mid-crisis is like packing a parachute after you’ve already jumped. Sure!

3. Why Wait-and-See Fails

Hesitation kills agility. In supply chain terms, this means watching a disruption unfold from the sidelines—then scrambling to catch up. Unfortunately, that reactionary mindset leads to costly consequences.

The High Cost of Inaction

When companies wait for pain points to become full-blown emergencies, they often:

- Burn capital on short-term fixes

- Rely on last-minute supplier changes

- Use costly expedited shipping

- Patch problems without addressing root causes

These reactive moves may keep operations afloat temporarily, but they quickly erode profit margins and reduce overall competitiveness.

Visibility Gaps Create Exponential Damage

One of the biggest risks of a wait-and-see approach is the delay in feedback loops:

- Forecast deviations are not corrected early

- Inventory imbalances skyrocket

- Missed revenue opportunities multiply

Without proactive optimization, visibility gaps grow wider—and the resulting misalignment compounds over time.

Pivoting Late is Painful—and Expensive

When disruption forces a sudden pivot, the cost can be steep and far-reaching. Emergency responses often lead to:

- Over-ordering

- Contractual penalties

- Inefficient workarounds

- Permanent loss of customer trust or supplier confidence

As highlighted in this overview of recession impacts on supply chains, unpredictable macroeconomic events expose outdated systems—often when it’s already too late to respond efficiently.

Bottom Line

Waiting for turbulence guarantees one thing:

You’ll fly straight into it—without a parachute.

Proactive strategies, not passive observation, are what drive resilience in today’s complex supply chains.

4. Core Pillars of Preemptive Supply Chain Optimization

When volatility hits, most businesses scramble. Best-in-class operators don’t — because they’ve already laid the groundwork. Preemptive optimization isn’t about predicting every shock. It’s about reducing exposure so your supply chain can adapt faster, bleed less, and recover stronger.

A. Holistic Inventory Optimization

Slashing inventory too deep too soon risks stockouts. Hoarding too much strangles cash flow. Holistic inventory is about hitting the sweet spot — right SKUs, right locations, right volumes.

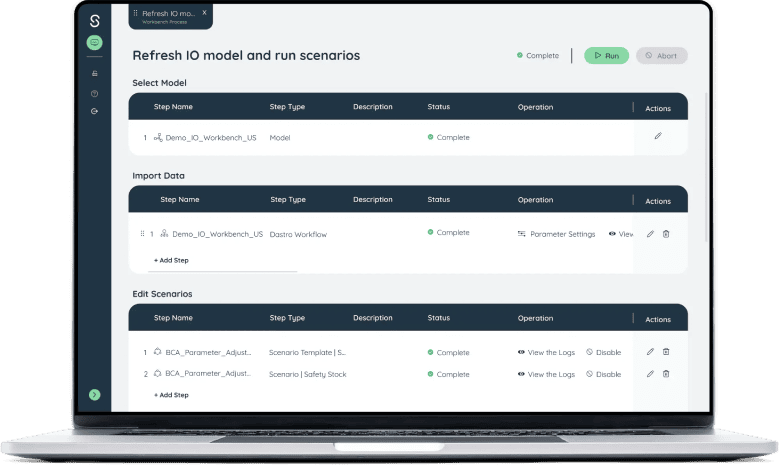

Modern tools help uncover where buffers can be trimmed safely and where rationalizing product mix makes sense for long-term margin. In short, less waste, more flexibility. This approach is walking the line between discipline and adaptability, and platforms like Sophus’ holistic inventory toolkit make it easier to balance.

???? Also read: Holistic Inventory Optimization

B. Replenishment Precision

If your restock plan still runs on last year’s rules, you’re behind. Demand signals are more erratic, consumer preferences don’t linger, and seasonality can’t be trusted. Precision replenishment is about staying synced to demand while balancing cost — knowing when to move, how much, and where. It’s not magic. It’s math backed by an optimization algorithm.

Replenishment optimization solutions like this one from Sophus help tune in to the signals and cut out the guesswork.

C. Network Design for Resilience

Modern network design demands a clean look at production centers, DCs, and last-mile strategies. Use data-driven frameworks to map risk, rebalance flows, and shift capacity before you’re forced to. Tools like network design solutions from Sophus enable simulations to test “what-if” scenarios — before real crises hit.

D. Annual Budget Alignment

Your budget is either enabling supply chain agility—or choking it. Preemptive optimization has to show up in the numbers. Aligning annual budget cycles with network and inventory strategy avoids disjointed investment that solves yesterday’s problems. Tools like this budgeting integration platform help connect financial validation to operational needs, so improvements don’t get shelved during planning season.

Bottom line? You don’t win a downturn. But you can decide whether it breaks you or makes you more nimble. These four pillars are how you choose the latter.

5. Strategic Takeaways

Supply chain optimization isn’t a “nice to have” after things go sideways—it’s ground prep before takeoff. Waiting for disruption before investing in your network is like choosing to fix your roof mid-storm: inefficient, expensive, and risky.

Build Resilience Before the Crisis

Resilience isn’t something you scramble to create during a disruption; it’s something you design into the system from the start.

- Proactive planning reduces long-term costs

- Early investment prevents costly firefighting later

- Networks designed for flexibility rebound faster

Balance Efficiency with Resilience

Success lies in striking a deliberate balance:

- Overbuilding drains profit margins

- Over-leaning exposes vulnerabilities

- Smart operators invest in flexible, scalable infrastructure

“You’re one partner delay away from chaos” — efficiency-only models often crack under pressure.

The ROI of Strategic Planning

Investing strategically pays off—not just in crisis response, but in long-term performance:

- Companies with optimized network design outperform reactive competitors

- Budgeting for optimization now avoids desperation spending later

- As this article clearly explains, planned investment beats reactive spend every time

Final Thought: Intentionality Wins

Spend purposefully, not regretfully.

Supply chain optimization isn’t a cost center—it’s a competitive advantage.

FAQs

1. Why is Supply Chain Optimization critical before an economic downturn?

Think of optimization like putting on body armor before heading into battle. Once the downturn hits, it’s too late—the inefficiencies are already bleeding cash.

Why optimize early?

· Enables leaner operations

· Increases agility for rapid shifts

· Reduces the need for reactive layoffs

· Enables proactive decision-making vs. panic-mode mistakes

Planning ahead turns chaos into calculated moves. This recession impact on supply chains highlights how unprepared supply chains struggle to stay afloat while optimized ones pivot and adapt without breaking.

2. What role does AI play in Supply Chain Optimization technologies?

AI isn’t just a buzzword—it’s your operations team’s unfair advantage.

Key benefits of AI in supply chain:

· Predicts demand shifts

· Identifies bottlenecks before they become a crisis

· Recommends smarter replenishment and logistics strategies

· Enhances forecasting accuracy and inventory planning

Instead of reacting to problems, AI positions you ahead of them—resulting in fewer shortages, tighter operations, and a more responsive supply chain.

3. How do tariffs affect network strategy and inventory decisions?

How tariffs impact supply chain decisions:

· Drives reassessment of sourcing strategies

· Requires rerouting and inventory reallocation

· Necessitates flexible, multi-tiered network planning

Accelerates moves toward nearshoring and regional buffers The key is resilience: build flexible supply chain models that can pivot when trade policies shift, rather than stall under pressure.